Case Study: Why do two WWII helmets that look nearly identical sell for very different prices?

WWII helmets often look nearly identical, yet their prices can vary dramatically. This raises an important question: what actually drives these differences in the militaria market?

To explore this, I built a structured dataset of more than 2,700 German helmets drawn from my larger militaria archive. Each entry includes details such as model, branch, completeness, decals, condition, dealer, and item description. These datapoints were extracted from product titles and descriptions using the OpenAI API with tailored prompts.

With this dataset in place, I conducted exploratory and statistical analyses to identify the features most strongly correlated with price and to explain why certain helmets consistently command higher values.

Objective

The goal of this analysis is to determine which factors — such as historical scarcity, dealer reputation, physical condition, or descriptive language — best explain price variation. Answering this question provides value for both collectors (spotting underpriced items) and sellers (understanding how to position items).

Approach

Data Preparation: Standardized messy product listings (inconsistent model names, missing values, duplicate entries).

Exploratory Analysis: Compared average, min/max, and distribution of prices across models and branches.

Deeper Analysis: Tested the impact of features (completeness, decals, dealer, keywords) using correlation and mutual information.

Insights: Identified the strongest drivers of price and uncovered why certain outliers (e.g., paratrooper helmets) consistently sell at premiums.

Data Preparation & Cleaning

This analysis uses a subset of 2,700+ German helmet listings drawn from my larger dataset of over 350,000 militaria products collected across 100+ dealer websites. Each record includes structured attributes (model, branch, decals, completeness, condition, dealer, price) as well as unstructured text from item titles and descriptions.

Challenges

Inconsistent naming conventions: e.g., “M1940” vs “M40,” “Heer” vs “Army.”

Duplicate listings: multiple dealers occasionally repost the same item.

Missing values: incomplete condition notes and missing dealer fields.

Messy free-text fields: valuable keywords buried in unstructured descriptions.

Approach

Standardization: normalized helmet model and branch names; standardized key categorical variables.

Deduplication: removed repeated listings based on item ID, title, and image similarity.

Missing data handling: filled where possible (e.g., branch inference from title) or excluded when unreliable.

Text parsing: applied Python and the OpenAI API to extract structured features (keywords, unit references, condition notes) from messy titles and descriptions.

Outcome

The result was a clean, analysis-ready dataset containing:

2,700+ German helmets

50+ structured attributes per record

Parsed keyword features for language analysis

This dataset provided the foundation for exploratory and statistical analysis of price variation.

Exploratory Analysis (Baseline Prices)

With the dataset cleaned and structured, the first step was to explore baseline price patterns across major categories of WWII German helmets. This establishes reference points before investigating outliers and more complex drivers of value.

Price by Model

Average prices:

M35 helmets: ~$2,209

M40 helmets: ~$1,645

M42 helmets: ~$1,378

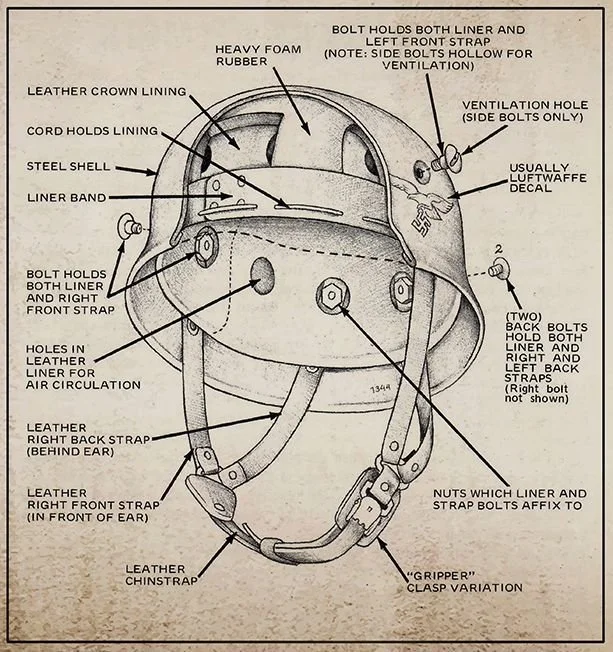

Key Insight: Earlier models (M35) consistently command higher prices because they represent early-war craftsmanship and iconic campaigns. Later models (M40, M42) were simplified for mass production, making them less scarce and less prized by collectors.

Price by Branch

I compared helmets attributed to the Army, Air Force, and Navy.

Key Insight: Branch affiliation has a weaker impact on price than expected. The differences exist, but they are modest compared to the much stronger variation by helmet model (M35 vs. M40 vs. M42).

Context:

In reality, the German military was structured with the Army as the dominant branch, followed by the Air Force, then the Navy. However, my dataset shows the Air Force is overrepresented relative to its actual size. This likely reflects collector availability and interest, not battlefield proportions.

Identifying Outliers

While baseline analysis showed predictable differences across helmet models, one category stood out as a clear outlier: the M38 paratrooper helmet.

Outlier Detection & Context

Prices for paratrooper helmets far exceed those of standard models (M35, M40, M42).

Only ~230,000 paratrooper helmets were produced, compared to ~14 million standard Army helmets.

This extreme rarity, combined with strong collector demand for elite-unit equipment, explains the substantial price premium.

Key Insight

Scarcity + demand create extreme deviations from baseline pricing. The paratrooper helmet is a textbook example of how outliers in the militaria market reflect both historical production numbers and modern collector interest.

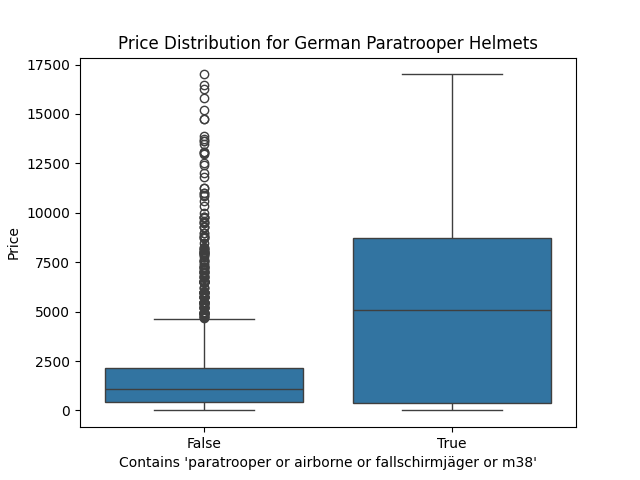

Boxplot: Price distribution for helmets with vs. without “paratrooper/airborne” terms

Helmets with paratrooper-related terms have a median price of roughly $3,500 compared to $1,200 for standard helmets, with outliers exceeding $8,000. This highlights the impact of historical scarcity and collector demand on price.

Feature Importance: What Really Drives Price?

What I tested:

Which features (site, completeness, decals, condition, etc.) are most predictive of helmet price.

Key results:

Dealer/Site → This has the strongest correlation. Certain dealers consistently sell at higher prices. This isn’t because the helmets are intrinsically different, but because of trust, reputation, and customer base. Collectors pay a premium for dealers known to vet authenticity.

Helmet Completeness → Helmets with liner + chinstrap fetch higher prices than shells/parts.

Decals & Condition → Premiums exist, but less strongly than dealer and completeness.

Minimal Impact Factors → Many granular fields (lot numbers, maker variations) have negligible influence.

Clarification — Correlation vs. Causation:

Dealer/Site doesn’t cause a helmet to be worth more.

Instead, it reflects collector behavior: buyers are willing to pay more when the seller has established credibility.

In other words, it’s a market trust premium — a correlation that’s driven by reputation, not helmet attributes.

Takeaway:

Price is shaped less by tiny technical details and more by contextual factors — who sells it, whether it’s complete, and whether it carries visible features like decals.

Mutual Information Bar Chart

Dealer/site (MI ≈ 0.45) provides the strongest predictive signal of price, followed by helmet completeness (MI ≈ 0.18). Decal presence and condition provide weaker signals (< 0.1), while most granular details (lot number, size code) contribute little.

Spearman Correlation Heatmap

Helmet completeness (ρ ≈ 0.41), decals (ρ ≈ 0.30), and dealer/site (ρ ≈ 0.23) show the strongest positive correlations with price. Most other attributes remain close to zero, confirming they have minimal influence on value.

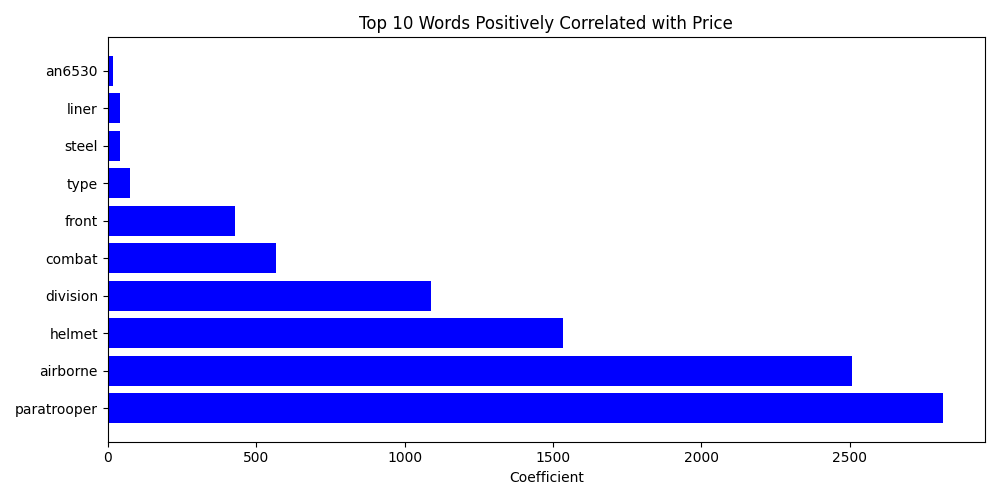

Keyword & Text Analysis

What I tested:

Whether certain words in titles/descriptions (like “paratrooper” or “Fallschirmjäger”) consistently correlate with higher prices.

What I found:

Elite-unit keywords (paratrooper/airborne/Fallschirmjäger) show 2–3× higher median prices, with outliers reaching over $8,000.

Generic descriptors (steel, liner, type) show only weak correlations, confirming they add little value.

Takeaway:

Keywords that signal rarity or elite status do meaningfully move the market. Generic descriptors don’t.

Comparative Distribution

This visual (Sankey chart below) illustrates how descriptive language flows from conflict → nation → item type, emphasizing how certain keywords cluster with higher-value categories.

Boxplot: “Paratrooper/Airborne” vs Other Helmets

Helmets with paratrooper-related terms have median prices ~2–3× higher than standard listings, with some exceeding $8,000.

Boxplot: Generic Terms (Steel, Liner, Type)

These generic descriptors show only weak positive correlations, far smaller than elite-unit terms, confirming they add little value relative to rarity-driven keywords.

Sankey Chart of Keywords

Keyword flow highlights how descriptive terms connect across conflicts, nations, and item types, with elite-unit language clustering in higher-value categories.

Insight

Language plays a critical role in price formation:

Elite-unit terms (e.g., paratrooper, SS, airborne) act as signals of rarity and desirability.

Generic descriptors (e.g., steel, liner) do not meaningfully shift buyer perception.

Effective use of keywords can therefore amplify or suppress value, independent of physical attributes.

Findings & Insights

Bringing together the exploratory, statistical, and text-based analyses, several consistent themes emerged about what drives helmet prices.

Key Findings

Dealer Reputation Matters Most

Prices vary significantly by dealer, even for similar items.

Trust, authentication standards, and customer reach allow some dealers to consistently charge premiums.

Completeness and Decals Drive Value

Complete helmets (with liner and chinstrap) fetch substantially higher prices than shells or parts.

Decal presence further boosts value, especially when multiple decals are intact.

Scarcity Creates Outliers

Paratrooper helmets (M38) stand apart due to limited wartime production (~230k vs 14m Army helmets) and strong collector demand.

Scarcity-driven items can reach several times the median market price.

Language Shapes Perception

Listings with elite-unit terms (e.g., “paratrooper,” “Fallschirmjäger,” “SS”) command 2–3× higher median prices than those without.

Generic descriptors (e.g., “steel,” “liner”) add little relative value.

Context > Condition

Who sells the item and how it is presented often matters more than minor physical attributes like lot number or small maker variations.

Section Takeaway

Pricing in the WWII helmet market is driven not only by intrinsic features (completeness, decals) but also by contextual and perceptual factors: the seller’s reputation, the scarcity of specific models, and the language used in descriptions.

Dealer Reputation Matters Most

Completeness and Decals Drive Value

Language Shapes Perception

Scarcity Creates Outliers

Context > Condition

Business Impact & Applications

The analysis highlights several actionable insights that extend beyond historical curiosity and directly inform how the militaria market operates.

For Sellers

Leverage Keywords: Use high-value descriptors (e.g., paratrooper, SS, Fallschirmjäger) to highlight rarity and historical significance.

Emphasize Completeness: Helmets with intact liners, chinstraps, and decals justify significantly higher asking prices.

Build Trust: Dealer reputation strongly influences value — transparent authentication and professional presentation can command price premiums.

For Collectors/Buyers

Spot Overpriced Listings: Be cautious of high premiums from top dealers when similar helmets are available elsewhere.

Seek Undervalued Opportunities: Listings missing high-value keywords or sold by less-known dealers may be priced below market potential.

Focus on Core Drivers: Prioritize completeness and decals over minor attributes (lot numbers, maker codes) that have little impact on value.

For Market Analysts & Researchers

Track Scarcity Premiums: Outliers such as M38 paratrooper helmets provide a model for understanding how production numbers translate into modern valuations.

Monitor Dealer Effects: Consistent dealer-level pricing differences suggest market segmentation worth tracking over time.

Quantify Language Effects: Text-based analysis demonstrates that descriptive framing measurably influences buyer behavior, an insight extendable to other collectible markets.

Section Takeaway

The factors driving helmet prices — scarcity, completeness, dealer reputation, and descriptive language — are not just historical curiosities. They form the foundation for a data-driven understanding of supply, demand, and market psychology, with direct applications for sellers, collectors, and researchers alike.

Conclusion

This case study set out to answer a deceptively simple question:

Why do two WWII helmets that appear nearly identical sell for vastly different prices?

Through data cleaning, exploratory analysis, statistical testing, and text mining, the findings show that price is not random, nor is it driven solely by physical condition. Instead, four consistent drivers emerged:

Dealer Reputation — Trust and authentication standards allow some sellers to consistently charge premiums.

Completeness and Decals — Helmets with intact liners, chinstraps, and decals are substantially more valuable than shells or partial examples.

Scarcity — Rare models, such as the M38 paratrooper helmet, command significant premiums, reflecting both historical production limits and collector demand.

Descriptive Language — Listings that emphasize elite-unit terms (e.g., paratrooper, SS, Fallschirmjäger) achieve higher prices, showing the influence of presentation and buyer perception.

Final Takeaway

Two helmets may look alike, but their value is shaped as much by context and perception as by the object itself. This analysis demonstrates how structured data, statistical methods, and text analytics can uncover the hidden drivers of price in a real-world market.